In one of several deals that energized markets yesterday, Abbott Laboratories (ABT)said it would pay $6.6 billion for the pharmaceutical business of Belgian chemicals maker Solvay.

The deal is the latest in a string of drug mergers and acquisitions, and one of three announcements yesterday that involved the fast-growing vaccines business.

Also yesterday, Johnson & Johnson Inc. bought an 18 percent stake in the Dutch biotechnology company Crucell NV, which is trying to develop a universal flu vaccine, while competitor Merck & Co. Inc. acquired the rights to sell Australia-based CSL Ltd.'s Afluria flu vaccine in the United States.

By purchasing Brussels-based Solvay, Abbott gains access to emerging markets in Eastern Europe and Asia along with new therapeutic areas, including hormone therapies and vaccines.

Solvay's flu vaccine Influvac gives Abbott an entrant in the burgeoning vaccines market, which is dominated by European pharmaceutical giants such as GlaxoSmithKline and Novartis.

http://www.philly.com/inquirer/business/20090929_Pharma-deal_flurry_ignites_stocks.html

Tuesday, September 29, 2009

Monday, September 21, 2009

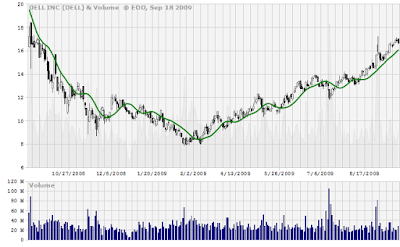

Dell to Buy Perot Systems September-21-2009

Dell agrees to buy Perot Systems for about $3.9B

Dell to buy Perot Systems for about $3.9B in cash, taking another step beyond the PC market

$16.69 -0.17 (1.01%) 52Wk Range: 7.84 - 18.44

http://finance.yahoo.com/news/Dell-agrees-to-buy-Perot-apf-3148015079.html?x=0&sec=topStories&pos=main&asset=&ccode=.

@@@

http://infodumy.blogspot.com/

Tuesday, July 28, 2009

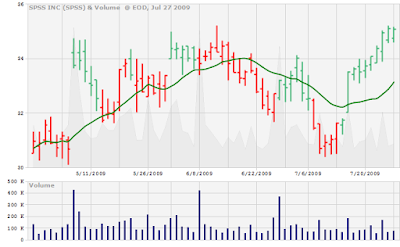

I.B.M.Acquires Software Maker SPSS July-28-09 TWX AOL

ARMONK, N.Y. I.B.M. said Tuesday that it would acquire a maker of analytics software maker, SPSS, in an all-cash transaction of $50 a share for a deal valued at about $1.2 billion.

$35.09 -0.01 (0.03%) 52Wk Range: 22.91 - 35.22

Time Warner Inc. (NYSE:TWX) also bought back the 5% stake in AOL that it sold to Google Inc. (NASDAQ:GOOG) for $1 billion in 2005 for the bargain price of $283 million. The deal, which occurred on July 8 according to SEC filings, gives Time Warner's Internet unit, which will soon be spun out, a valuation of less than $5.66 billion.

http://www.thedeal.com/dealscape/2009/07/ibm_spss_twx_goog_db_bac.php

http://www.nytimes.com/2009/07/29/technology/companies/29ibm.html?ref=business

http://www.thedeal.com/

Sunday, June 14, 2009

Six Flags Filing Chapter 11 Bankruptcy June-14 2009

Debt-ridden amusement park operator Six Flags has filed for Chapter 11 bankruptcy reorganization.

The New York-based chain of parks, which runs Six Flags Discovery Kingdom in Vallejo, has been trying to renegotiate terms with lenders on hundreds of millions of dollars in debt.

Six Flags parks, including Discovery Kingdom., will continue to operate as usual under reorganization.

“The current management team inherited a $2.4 billion debt load that cannot be sustained, particularly in these challenging financial markets,” said Six Flags Chief Executive Mark Shapiro in a statement. “As a result, we are cleaning up the past and positioning the company for future growth.”

Ticker SIX from PKS.

http://news.moneycentral.msn.com/provider/providerarticle.aspx?feed=ACBJ&date=20090614&id=10019595

http://www.hollywoodreporter.com/hr/search/article_display.jsp?vnu_content_id=1002576713

Six Flags Filing Chapter 11 Bankruptcy June-14 2009

Debt-ridden amusement park operator Six Flags has filed for Chapter 11 bankruptcy reorganization.

The New York-based chain of parks, which runs Six Flags Discovery Kingdom in Vallejo, has been trying to renegotiate terms with lenders on hundreds of millions of dollars in debt.

Six Flags parks, including Discovery Kingdom., will continue to operate as usual under reorganization.

The New York-based chain of parks, which runs Six Flags Discovery Kingdom in Vallejo, has been trying to renegotiate terms with lenders on hundreds of millions of dollars in debt.

Six Flags parks, including Discovery Kingdom., will continue to operate as usual under reorganization.

Wednesday, April 1, 2009

Thursday, March 12, 2009

Roche Purchase of Genentech March-12 2009

Roche to take over Genentech for $47 billion- AP

Swiss pharmaceutical giant Roche said Thursday it has agreed to buy California-based Genentech for $46.8 billion in a takeover described as the largest in Swiss corporate history.

Swiss pharmaceutical giant Roche said Thursday it has agreed to buy California-based Genentech for $46.8 billion in a takeover described as the largest in Swiss corporate history.

Monday, February 2, 2009

Genentech (DNA) Will It Be Sold February-2 2009

Genentech (DNA)

Will Shareholders Agree to Sell Genentech?

About six months ago, Swiss drugmaker Roche offered to buy out all of Genentech's remaining stock in a deal worth $44 billion. This equaled about $89 per share and represented a 9 percent premium. The board of directors evaluated this offer and about a month later, rejected the bid saying the price significantly undervalued the company's worth and growth potential. Little else has occurred since, but on Friday, Roche took the deal directly to shareholders asking to buy their equity stake for $86.50 per share. The US biotech firm advised shareholders not to take action so it can review its current position and prepare a formal response. Investors and analysts expect an announcement within a week or two. Last Friday, Genentech's stock closed at $81.50, indicating investors are complying. Having been rejected once by the company, will Roche be rejected a second time by shareholders?

http://us.mc1115.mail.yahoo.com/mc/showMessage?fid=Inbox&sort=date&order=down&startMid=0&.rand=863630971&da=0&midIndex=15&mid=1_10169187_ANkPw0MAAL3PSYeJrg0nN2ooyYs&prevMid=1_10169885_ALUPw0MAAVVJSYePggoeMQrkc5g&nextMid=1_10168655_AMcPw0MAAQo9SYeAeQ8StXCoflE&m=1_10173247_AKkPw0MAAJI7SYeo8gchUXoQxoo,1_10171928_ANkPw0MAADcISYemYw8fPXmEKy4,1_10171215_AJEPw0MAATvNSYehmgUjMVeXJH0,1_10170619_ALUPw0MAAAsCSYeXPQBBHiqFzw4,1_10169885_ALUPw0MAAVVJSYePggoeMQrkc5g,1_10169187_ANkPw0MAAL3PSYeJrg0nN2ooyYs,1_10168655_AMcPw0MAAQo9SYeAeQ8StXCoflE,1_10168118_AK8Pw0MAASzbSYd6bw01el3Luu8,1_10165098_AKMPw0MAAJTZSYdkAwkFcztQT%2Fc,1_10166808_AMcPw0MAADi4SYdoUgMDBx8Nx%2B4,1_10163494_AM0Pw0MAARjjSYdiRQMuwVNgXlE,

Relaxation

http://lifeisallaboutsmileandcry.blogspot.com/

Will Shareholders Agree to Sell Genentech?

About six months ago, Swiss drugmaker Roche offered to buy out all of Genentech's remaining stock in a deal worth $44 billion. This equaled about $89 per share and represented a 9 percent premium. The board of directors evaluated this offer and about a month later, rejected the bid saying the price significantly undervalued the company's worth and growth potential. Little else has occurred since, but on Friday, Roche took the deal directly to shareholders asking to buy their equity stake for $86.50 per share. The US biotech firm advised shareholders not to take action so it can review its current position and prepare a formal response. Investors and analysts expect an announcement within a week or two. Last Friday, Genentech's stock closed at $81.50, indicating investors are complying. Having been rejected once by the company, will Roche be rejected a second time by shareholders?

http://us.mc1115.mail.yahoo.com/mc/showMessage?fid=Inbox&sort=date&order=down&startMid=0&.rand=863630971&da=0&midIndex=15&mid=1_10169187_ANkPw0MAAL3PSYeJrg0nN2ooyYs&prevMid=1_10169885_ALUPw0MAAVVJSYePggoeMQrkc5g&nextMid=1_10168655_AMcPw0MAAQo9SYeAeQ8StXCoflE&m=1_10173247_AKkPw0MAAJI7SYeo8gchUXoQxoo,1_10171928_ANkPw0MAADcISYemYw8fPXmEKy4,1_10171215_AJEPw0MAATvNSYehmgUjMVeXJH0,1_10170619_ALUPw0MAAAsCSYeXPQBBHiqFzw4,1_10169885_ALUPw0MAAVVJSYePggoeMQrkc5g,1_10169187_ANkPw0MAAL3PSYeJrg0nN2ooyYs,1_10168655_AMcPw0MAAQo9SYeAeQ8StXCoflE,1_10168118_AK8Pw0MAASzbSYd6bw01el3Luu8,1_10165098_AKMPw0MAAJTZSYdkAwkFcztQT%2Fc,1_10166808_AMcPw0MAADi4SYdoUgMDBx8Nx%2B4,1_10163494_AM0Pw0MAARjjSYdiRQMuwVNgXlE,

Relaxation

http://lifeisallaboutsmileandcry.blogspot.com/

Subscribe to:

Posts (Atom)